Appendix A: A Brief History of Central Bank Initiated Wars

"If my sons did not want wars, there would be none." - Gutle Schnaper, wife of Mayer Amschel Rothschild and mother of his five sons

This Appendix provides additional clarity to Goals, Motivations and Strategies of the Owners of Modern Society.

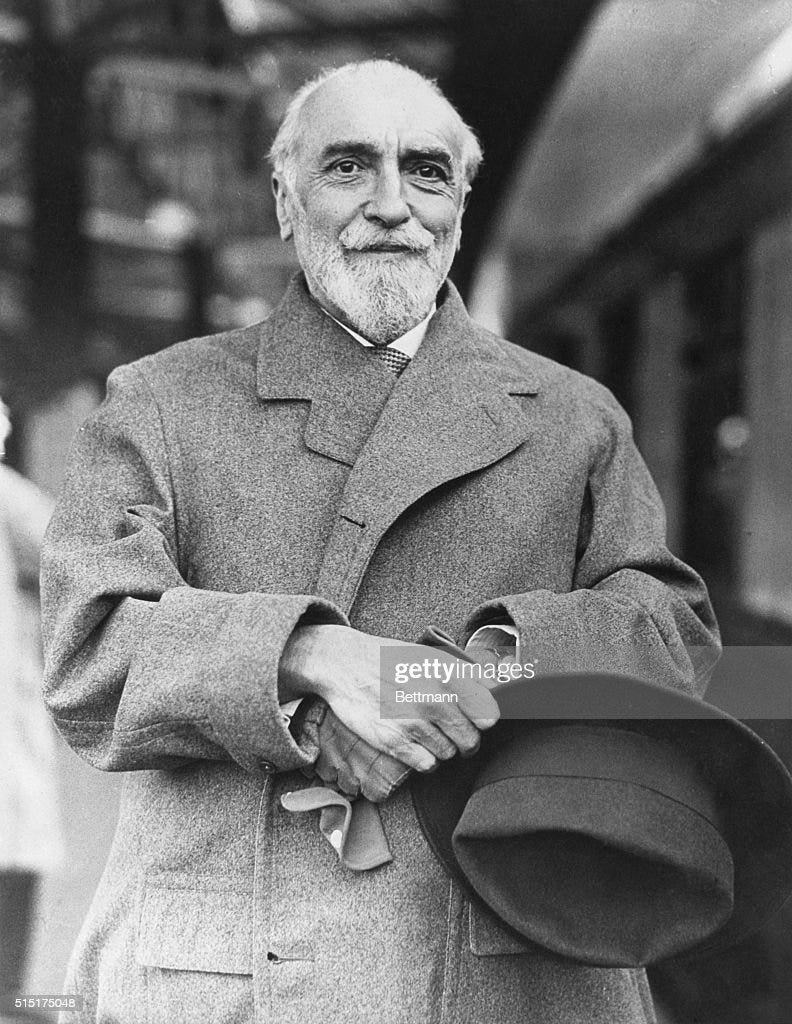

The following describes some of the modern history of the Rothschild and their allies’s targeting of their publicly-owned central bank competition for destruction: Napoleon in the early 1800s, Russia in World War 1, Germany, Italy and Japan in World War 2, and Libya, Iraq, Syria, Belarus and Burma in the modern era. Each of these examples demonstrates that when central banks are publicly owned their economies perform exceptionally well, featuring low interest loans, state directed investments, triple digit growth rates, zero unemployment and low inflation. Much of the following is taken from Stephen Mitford Goodson’s book A History of Central Banking and the Enslavement of Mankind unless otherwise noted. Goodson was a director of the South African Reserve Bank from 2003 to 2012 and is a descendent of the famous Mitford sisters and is well qualified to comment on such matters.

Napoleon the Monetary Reformer1

Napoleon was consciously mindful of the fact that money always remains in hiding and only acts through agents who are often unaware of the aims that they are pursuing. He realized that international money stood behind every foreign enemy, every monarch and every political party, including the Jacobins, stating on one occasion that “The hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.” He set up the Banque de France in 1799, which replaced the 15 private banking houses which had been involved in the events leading up to the French Revolution. The banks had increased the national debt to 170 million Francs and had charged rapacious rates of interest on loans to the French crown to the extent that prior to 1789, it was allocating over 50% of its budget expenditure to interest. Napoleon made himself president of the bank, declaring that “The bank does not belong to the shareholders only; it also belongs to the state, since the state has entrusted to it the privilege of issuing money.”

Napoleon was so suspicious and distrustful of bankers that he personally supervised the operations of the Treasury lest the secrets of his monetary policies leak out and be exploited by speculators. He was thus his own banker who controlled both the creation and distribution of money and credit, to the chagrin of the international bankers, particularly the Rothschilds, who were virtually excluded from operating in continental markets. Napoleon made the franc the most stable currency in Europe. After France had abandoned the loan markets of the City of London, a fog of depression settled on its fraternity of bankers and usurers. In typical fashion the English press began to stir up trouble for Napoleon. England, under the direction of her international bankers, proceeded to bankroll Austria, Prussia, Russia, Spain and Sweden and duly declared war on France. Napoleon was forced to engage in a series of needless and senseless wars for the next nine years in order to protect France.

At the Treaty of Tilsit signed on July 7 1807, Napoleon and Tsar Alexander agreed to an alliance which made them the masters of continental Europe. At the time France and Russia were the only two countries in Europe which were not on the usury system and were furthermore not indebted to the Rothschilds. However, Russia was dependent on England for the importation of industrial products and England threatened to cut Russia off; Alexander was only prepared to join Napoleon’s blockade of England if France would supply Russia with the industrial goods, which France could not supply. Therefore Napoleon invaded Russia to enforce the blockade, which failed.

When Napoleon attempted to stage his comeback at the battle of Waterloo, he gave in and was financed by the Rothschilds along with the rest of the parties (England, Prussia and France were all financed by Nathan Rothschild, with France receiving a loan of 10 million pounds); he lost, was banished to the island of Saint Helena and then poisoned to death.

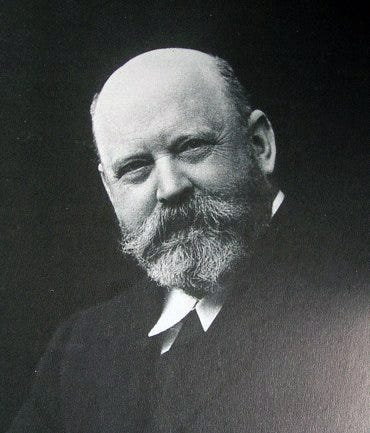

The State Bank of the Russian Empire2

The State Bank of the Russian Empire was founded in 1860 under the control and ownership of the Tsar. The Russian State bank printed money at almost zero interest, as opposed to the rest of the world where privately owned central banks created their nation's money supply at usurious rates of interest. It comes as no surprise to find that in 1912 Russia had the lowest levels of taxation in the world. The total direct tax rate per inhabitant that year was 26.75%, Germany was 12.97%, France was 12.35%, Austria was 10.19% and Russia’s was 2.66%. Russia had the smallest national debt in the world. Its vast gold reserves, the largest in the world, exceeded the bank note issue by more than 100% except for the year 1906. Furthermore throughout this period of state banking there was no inflation and no unemployment. Russian citizens experienced massively increased quality of life and industrial production during this period:

After the passing of the Stolypin Act in 1906, peasants could obtain individual title with hereditary rights (Stolypin was assassinated by Mordechai Gershkovich in 1911). By 1913 two million families had availed themselves of this opportunity to acquire what became known as “Stolypin farms.” The Peasants’ State Bank, which was described at that time as the “greatest and most socially beneficent institution of land credit in the world” granted loans at a very low rate of interest. Agricultural production soared as a result - its production of cereals exceeded the combined production of Argentina, Canada and the United States by 25% in 1913. In that year Russia had 37.5 million horses, more than half of all those in the world. Russia produced 80% of the world’s flax and provided more than 50% of the world’s egg imports. Mining and industrial output expanded by huge margins. Between 1885 and 1913 coal production increased from 259.6 million woods to 2,159.8 million poods, cast iron production rose form 25 million poods in 1890 to 1,378 million poods in 1913 and petroleum production rose from 491.2 million poods in 1906 to 602.1 million poods in 1916. From 1870 to 1914 industrial output grew by 1% per annum in Great Britain, 2.75% per annum in the United States and 3.5% per annum in Russia. During the period from 1890 to 1913 industrial production quadrupled; the increase in GDP averaged 10% per annum between 1895-1914.

An independent study by British lawyers concluded that the Russian Code of Laws and judiciary were “the most advanced and impartial in the world.” Elementary education was obligatory and free up to university level, where only nominal fees were charged. Their schools were renowned for their high academic standards.

In labor relations the Russians were pioneers. Child labor was abolished over 100 years before it was abolished in Great Britain in 1867. Strikes, which were forbidden in the Soviet Union, were permitted and minimal in Tsarist times. Trade union rights were recognized in 1906, while an Inspectorate of Labour strictly controlled working conditions in factories. In 1912 social insurance was introduced.

In 1917, the Rothschilds, fearful that replication of this extraordinary example of freedom and prosperity would destroy their malevolent banking empire, instigated and financed the Bolshevik revolution which wrecked and ruined Russia. By the end of 1916 the British and French armies were in danger of losing the war, with the latter army having already mutinied on the Western front. Lord Walter Rothschild out of the blue offered to secure American intervention in return for handling over Palestine, resulting in the Balfour Declaration; war dragged on for two more years and Russia was totally destroyed, paving the way for the Bolshevik Revolution which the Rothschilds also financed and instigated. Gutle Schnapper, Mayer Amschel Rothschild's wife, is reputed to have said shortly before her death in 1849, “If my sons did not want war, there would have been none.”3

Germany in World War 24

In May 1919 Adolf Hitler attended a lecture by Dr. Gottfried Feder entitled “The Abolition of Interest Servitude.” This lecture had a decisive influence on Hitler’s thinking as he explained in Mein Kampf:

“To my mind, Feder's merit consisted in the ruthless and trenchant way in which he described the double character of the capital engaged in stock exchange and loan transactions, laying bare the fact that this capital is every and always dependent on the payment of interest…I understood immediately that here was a truth of transcendental importance for the future of the German people. The absolute separation of stock exchange capital from the economic life of the nation would make it possible to oppose the process of internationalization in German business without at the same time attacking capital as such, for to do this would be to jeopardize the foundations of our national independence. I clearly saw what was developing in Germany, and I realized then that the stiffest fight we would have to wage would not be against the enemy nations but against international capital. In Feder's speech I found an effective rallying-cry for our coming struggle.”

When Hitler joined the National Socialist German Workers Party, Feder was the principal drafter of the party’s 25 points and monetary reform was the core essence of the program. The following extract is from the party platform:

“Break down the thralldom of interest is our war cry. What do we mean by the thralldom of interest? The landowner is under this thralldom, who has to raise loans to finance his farming operations, loans at such high interest as almost to eat up the results of his labour, or who is forced to make debts and to drag the mortgages after him like so much lead. So is the worker, producing in shops and factories for a pittance, whilst the shareholder draws dividend and bonuses which he has not worked for. So is the earning middle class, whose work goes almost entirely to pay the interest on bank overdrafts.

Thralldom of interest is the real expression for the antagonisms, capital versus labour, blood versus money, creative work versus exploitation. The necessity of breaking this thralldom is of such vast importance for our nation and our race, that on it alone depends our nation’s hope of rising up from its shame and slavery; in fact the hope of recovering happiness, prosperity and civilization throughout the world. It is the pivot on which everything turns; it is far more than mere necessity of financial policy. Whilst its principles and consequences bite deep into political and economic life, it is a leading question for economic study, and thus affects every single individual and demands a decision from each one: Service to the nation or unlimited private enrichment. It means a solution of the Social Question.

Our financial principal: Finance shall exist for the benefit of the state; the financial magnates shall not form a state within the state. Hence our aim to break the thralldom of interest. Relief of the state, and hence of the nation, from its indebtedness to the great financial houses, which lend on interest. Nationalisation of the Reichbank and the issuing houses, which lend on interest. Provision of money for all great public objects (waterpower, railroads etc), not by means of loans, but by granting non-interest bearing state bonds and without using ready money…Wanton printing of bank notes, without creating new values, means inflation. We all lived through it. But the correct conclusion is that an issue of non-interest bearing bonds by the state cannot produce inflation if new values are at the same time created.”

In 1933 the National Socialists came to power and a somewhat attenuated version of Feder’s monetary reform was introduced. From being a ruined and bankrupt nation in January 1933 with 7,500,000 unemployed persons, they transformed the country and increased citizen’s standards of living dramatically by 1939:

The provision of adequate housing. During the period 1933-37 1,458,178 new homes were built to the highest standards of the time. The building of apartments was discouraged and rental payments on housing were not permitted to exceed 1/8 of the income of an average worker.

Interest free loans of about 5 months of gross pay were paid to newly-wed couples to finance the purchase of household goods. The loan was repayable at 1% per month, but for each child born 25% of the loan was cancelled. The same principle was applied in respect of home loans, which were issued for a period of 10 years at a low rate of interest. The birth of each child also resulted in cancellation of 25% of the loan. Education in schools, technical colleges and universities was free, while the universal health care system provided everyone with free medical care.

During the period 1933-37 imports increased by 31% while exports rose 20.4%. This increased trade is reflected in the 76.9% rise in inland shipping and the 69.4% rise in ocean shipping. During this period trade was greatly enhanced by barter, which bypassed the international payments system and the requirement of having to pay commission and interest on bills of exchange. By the late 1930s 50% of all foreign trade was being conducted by means of barter transactions using offset accounting.

During this period expenditures on roads rose by 229.5% to accommodate the 425% increase in vehicles and 622% increase in licensed commercial vehicles.

Between 1932 and 1938 iron ore production increased by 45.4%, the index of coal production rose by 85.5% and the energy index rose by 76%.

As a result of this heightened and ever increasing economic activity, unemployment, which was at 30.1% in 1933, had been reduced to almost zero by July 1939. In contrast the unemployment rate in the United States, which had stood at 25.1% in 1933, was still at 19.8% by January 1940. National income in Germany rose by 434.8% while between 1932 and 1939 the index of producers goods increased by 219.6%, yet the cost of living advanced by only 4% or less than 1% per annum, a rate which would be stable throughout the 12 years of state banking under national socialism. The German monetary policy “was non-inflationary because government expenditures, which increased the level of consumer demand, could in turn elicit a correspondingly increased quantity of disposable consumer goods.” By 1939 Germany had become the most powerful country in the history of Europe. Its GDP had an annual average growth rate of 11% per annum had doubled in the short space of six years of quasi-state banking. And this was conducted without basing the economy on armaments production. The following table reveals modest levels of defense expenditure which only picked up in 1938/1939 when Germany started to feel threatened by her neighbors.

Even expenditure of 22% of national income on defense just before World War II started may be deemed as not being too excessive, when one bears in mind that Germany’s borders possess few natural boundaries and she was surrounded by hostile neighbours – Czechoslovakia, France and Poland. Germany also had to replenish the armaments which she had been forbidden to possess in terms of the Treaty of Versailles. The renowned English historian AJP Taylor wrote, “The state of German armament in 1939 gives the decisive proof that Hitler was not contemplating general war, and probably not intending war at all.”

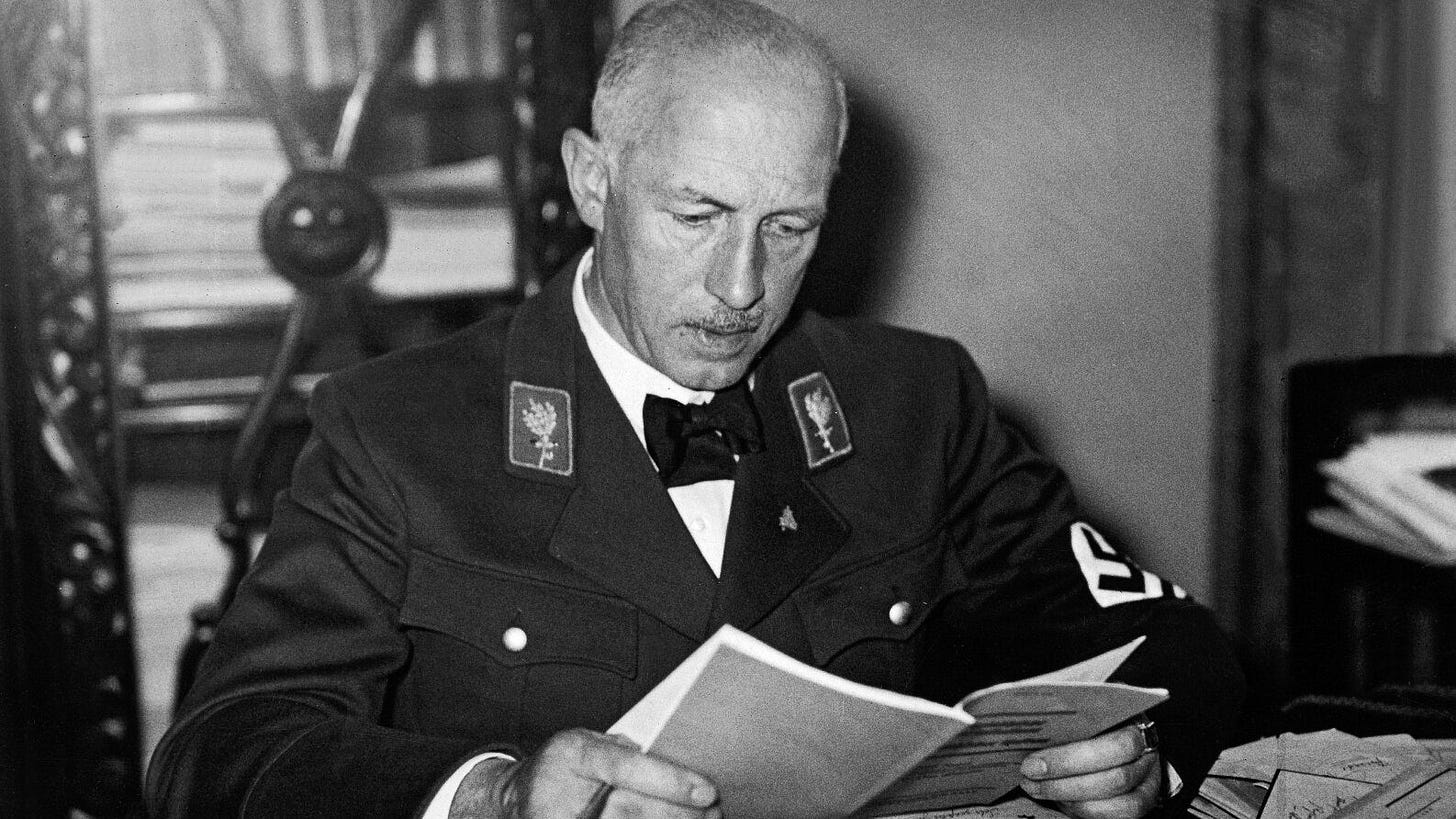

The Rothschilds path to war: In January 1939 the President of the Reichbank, Hjalmar Schacht (a Rothschild puppet), issued an ultimatum to Hitler demanding he change his monetary policies and collapse the German economy, which had increased its GNP by 100% between 1933-1939. Hitler was furious and rejected the recommendations as “mutiny” and sacked him two weeks later. The Reichsbank was ordered to grant the Reich all credits requested by Hitler, which had the effect of removing from the bankers the power to deflate and destroy the German economy. Thus only in January 1939 did the Reichsbank become an authentic State Bank. Schacht's dismissal also terminated the transfer of confidential information regarding all Germany's economic developments, which he had been deviously giving without interruption to Montagu Norman, a fellow mason and Governor of the Bank of England. But the central bank owners had the economic figures they needed for their calculations — the overall economic production of what would become the Allies dramatically outpaced what would become the Axis by anywhere from a 3:1 to a 10:1 ratio depending on category, from oil to air and naval forces to manpower to tank production to munitions, which gave them the comfort level they desired of an assured victory before green-lighting the manipulation of the world toward war.

(On a side note, the relative closeness of the outcome of the war despite the central banker’s calculations5 was because of (1) Hitler’s strategic boldness with blitzkreig in France, which caught them by surprise, and there is a controversy over whether Stalin was only weeks away from attacking Germany when Germany attacked first in Barbarossa; and (2) the German soldier was so far superior to Russian, American or British soldiers. Trevor N. Dupuy, a noted American military analyst, US Army Colonel and author of numerous books and articles, studied the comparative performance of the soldiers of World War II. On average, he concluded, 100 German soldiers were the equivalent of 120 American, British or French soldiers, or 200 Soviet soldiers. “On a man for man basis,” Dupuy wrote, “German ground soldiers consistently inflicted casualties at about a 50 percent higher rate than they incurred from the opposing British and American troops under all circumstances. This was true when they were attacking and when they were defending, when they had a local numerical superiority and when, as was usually the case, they were outnumbered, when they had air superiority and when they did not, when they won and when they lost.” Many other noted historians agreed with this assessment).

A new Reichsbank law made the bank "unconditionally subordinated to the sovereignty of the state.” Hitler was now his own banker, but having departed from the fold of international swindlers and usurers he would, like Napoleon, who in 1800 had established the Basque de France as a state bank, suffer the same fate; an unnecessary war followed by the ruination of his people and country. It was this event which triggered World War II - the realization by the Rothschilds that universal replication of Germany’s usury-free state banking system would permanently destroy their evil financial empire.

In order to provide the Poles with a free hand which would enable them to antagonize and provoke the Germans, a deceitful offer to guarantee Poland's sovereignty was given by Great Britain on March 31, 1939, but it was only a guarantee against a war with Germany, not invasion by the Soviet Union (who took 77,300 square miles as opposed to the 49,800 square miles ultimately restored to Germany). During the next five months the Polish government progressively intensified the oppression, harassment of and attacks on the remaining 1.5 million ethnic Germans living in Poland. These attacks, in which over 58,000 German civilians were killed by Poles in acts of savagery, culminated in the Bromberg massacre on September 3, 1939 in which 5,500 people were murdered. On August 30, 1939 Hitler again offered to the Polish government the Marienwerder proposals but on the order of the international bankers, the British Foreign Secretary strongly advised the Polish government not to negotiate. From 1939 onwards, although Germany made at least 28 known attempts at peace without conditions, they were all refused.

Italy in World War 26

In 1927 Italy received a loan from JP Morgan of $100 million to meet a special emergency. Thereafter Mussolini refused "to negotiate or accept any more foreign loans”, as “he was determined to keep Italy free from financial subservience to foreign banking interests.” In 1931 the Italian state arrogated to itself the right to supervise the banks by means of the Institute of Italian Securities. In 1936 the process was completed when by means of the Banking Reform Act, where the Banca d’Italia and the major banks became state institutions. The Banca d’Italia was now a fully-fledged state bank which had the sole right to create credit out of nothing and advance it for a nominal fee to other banks. Limits on state borrowing were lifted and Italy abandoned the gold standard.

Japan in World War 2

The Bank of Japan was founded in 1882 as a typical central bank, i.e. for the benefit of private banks to the detriment of the public interest. This changed in 1932 when the Bank of Japan was reorganized into a state bank administered for the national interests. The reform of the bank was completed in 1942 when the Bank of Japan Law was remodeled on Germany’s Reichsbank Act of 1939. Japan had been experiencing the same traumatic difficulties caused by the artificially created Great Depression (Herbert Hoover stated in his Memoirs, “I considered for some time whether I should expose the responsibility of the Federal Reserve Board by its deliberate inflation policies from 1925-28 under European influence, and my opposition to these policies”, but he remained silent7). However, the conversion from a central to a state banking methodology produced results which were both swift and sustained. During the 1931-41 period manufacturing output and industrial production increased by 140% and 136% respectively, while national income and GNP went up 241% and 259% respectively. These remarkable increases exceeded by a wide margin the economic growth of the rest of the industrialized world. Unemployment declined from 5.5% in 1930 to 3.0% in 1938. Industrial disputes decreased with the number of stoppages down from 998 in 1931 to 159 in 1941.

By the late 1930s Japan had become the leading economic power in East Asia and her exports were steadily replacing those of America and England. In August 1940 Japan announced the formation of the Greater East Asian C-prosperity Sphere. The fear that these countries would adopt Japan's state banking methods posed such a serious threat to the Rothschild owned and controlled US Federal Reserve Bank that a war was deemed the only means of countering it.8

Henry Stimson, War Secretary and a patriarch of the CFR, wrote in his diary after meeting with FDR: “We face the delicate question of the diplomatic fencing to be done so as to be sure Japan is put into the wrong and makes the first bad move - overt move.” After a subsequent meeting, he recorded: “The question was how we should maneuver them [the Japanese] into the position of firing the first shot…” The Council’s War and Peace Studies Project sent a memorandum to FDR recommending a trade embargo against Japan which he eventually enacted. In Addition, Japan’s assets in America were frozen and the Panama Canal closed to its shipping. FDR knew about the upcoming attack on Pearl Harbor (American military intelligence had cracked the radio code Tokyo used to communicate with its embassies, which suggested an assault would come on Pearl Harbor around December 7; in addition separate warnings were transmitted to high government officials) but no alert was passed on to the commanders in Hawaii. FDR removed the fleet’s Admiral after he protested that it was quite vulnerable to attack, and FDR stripped the island of most of its air defenses shortly before the raid. FDR appointed a commission to investigate what happened, headed by FDR’s friend Supreme Court justice Owen Roberts and other CFR members, absolving FDR of blame. When this whitewash was exposed, FDR suppressed the results, saying public revelation would endanger national security in wartime.9

In a speech on October 30, 1940, FDR declared “I have said this before, but I shall say it again and again and again: Your boys are not going to be sent into any foreign wars.” But he was planning the opposite. In 1940, at the American embassy in London, a code clerk named Tyler Kent discovered secret dispatches between Churchill and FDR, revealing the latter’s intention to bring the U.S. into the war. Kent tried to alert the public but he was caught and spent the rest of the war in prison. Robert Sherbowd, the President's friendly biographer, said “If the isolationists had known the full extent of the secret alliance between the United States and Britain, their demands for the President’s impeachment would have rumbled like thunder through the land.”10

Central Bank of Libya11

On assuming power in 1969 al-Gaddafi took control of most of the economic activities in the country, including the central bank, which for all practical purposes was run as a state bank. Foreign bankers were not permitted to operate. Financing of government infrastructure did not attract interest and Libya had no national debt and no foreign debt. Its foreign exchange reserves exceeded $54 billion, which may be compared to reserves of developed countries such as the UK and Canada which in 2010 were $50 billion and $40 billion respectively. The official figure for inflation from 2000-2010 was -0.27% and GDP growth was 4.32% per annum.

Gaddfai was described by the mainstream media as being a “terrible dictator and a blood-sucking monster”, but the reality was that with the exception of Benghazi and its environs he had the support of 90% of the population. The following benefits he provided explains why he was so popular: free education, students were paid the average salary for which subject they were studying, students studying oversees were provided with accommodation, an automobile and 2,500 euro per annum; free electricity, free health care, free housing (there were no mortgages), newly-wed couples received a gift of $50,000 from the government, automobiles were sold at factory cost free of interest, private loans were provided free of interest, bread cost 15 US cents per loaf, gasoline cost 12 US cents per litre, portion of profits from sale of oil was paid directly into bank accounts of citizens, farmers received free land, seeds and animals, and full employment with those temporarily unemployed paid a full salary as if employed.

Gaddafi ensured that the wealth of the country was fairly distributed to its people. Beggers and homeless did not exist while life expectancy at 75 years was the highest in Africa and 10% above the world average. Another major achievement was the Great Man-Made River Project, which supplied 6,500,000m of fresh water daily with costs ten times cheaper than desalinated water. Although the central banks of Belarus, Burma, Cuba, Iran, North Korea, North Sudan and Syria do not fall under the direct control of the Rothschild banking syndicate, Libya had the only central bank run on genuine state banking lines, which exhibited the classic symptoms of full employment, zero inflation and a modern day workers' paradise. The question arises as to why NATO intervened on the pretext of fabricated human rights abuses, the so called responsibility to protect. Since 1971 when the US abandoned the gold exchange standard for the petrodollar with the connivance of Saudi Arabia, any attempt to displace the United States dollar as the premier reserve currency has been blocked and opposed with violence.

Gaddafi announced in 2010 the creation of the gold dinar as a replacement for the settlement of all foreign transactions in a proposed region of over 200 million people. Libya at that time possessed 144 tons of gold. What was intended was not a return to the gold standard per se, but a new unit of accounts with oil exports and other resources being paid for in gold dinars. Gaddafi crossed a red line and paid the ultimate price.

Iraq, Syria, Belarus and Burma12

In November 2000 Saddam Hussein of Iraq decreed that all oil payments would in the future be made in euros, as he did not wish to deal "in the currency of the enemy.” The possession of weapons of mass destruction was a deliberately concocted hoax and it was this currency decision which cost him his life and the destruction of his country.

Belarus saw its President, Alexander Lukashenko, halt privatization, centralize power, and nationalize finance. While Ukraine even prior to 2022 had lost 70% of it industry and sees 80% of its well educated population below the poverty line, Belorussian unemployment is 1% and her industry has grown by an average of 10% yearly since 2000. The U.S. attempted a coup attempt in Belarus in 2021, which failed. Prior to the wars that ravaged both states, Libya and Syria were also registering double digit yearly growth, popular presidents and both countries were closing in on first world status. Both countries had state controlled banks and state-directed investments. The state was a partner in investment, not the result of it. Saddam was doing the same thing until the US engineered war in Iraq.

The Burmese state bank is under the control of a major general. The Burmese are taking no chances with foreign manipulation of their currency. Given the country's civil war, western sanctions and separatist movements, it has still managed to build 10 universities since 1999, several dozen dams, increased literacy to 80% and ensured that peasants own their own land.

***

Appendix B provides a caveat to the willpower behind the central bank system by discussing the rise of a self-perpetuating capitalist matrix.

Goodson, selected passages from 54-60.

Ibid, selected passages from 76-82.

Ibid, 95.

Ibid, selected passages from 121-136.

One detailed analysis argues that a 1% increase in Germany’s forces would have won them the war in Russia.

Goodson, 138-139.

Mullins, 109.

Goodson, 140-142.

Ibid, 66-68.

Perloff, 65.

Goodson, 151-154.

Ibid, 183-184.

I am writing “The Birth of Bitcoin”. A fictional story of how Satoshi Nakamoto invented Bitcoin.

In my story Satoshi has a tinfoil-hat wearing friend who warns Satoshi against building Bitcoin. He shows Satoshi a list of all presidents who mysteriously were assassinated for opposing bankers.

We work from patterns to details and although world history is a story full to infinity and beyond with details - this IS the pattern. Usury’s curse and central bank psychopaths